While it may seem next to impossible to get approved for a car loan with bad credit, with the right approach, it can be done. Banks, credit unions, online lenders, and car dealerships offer different financing opportunities for borrowers with less-than-perfect credit.

It’s no secret that your credit history plays a key role in your financing options and interest rates. Higher credit scores typically unlock more favorable financing options, including lower interest rates and more affordable monthly payments. However, even with poor credit, you can still secure financing, build your credit, and work toward better rates over time.

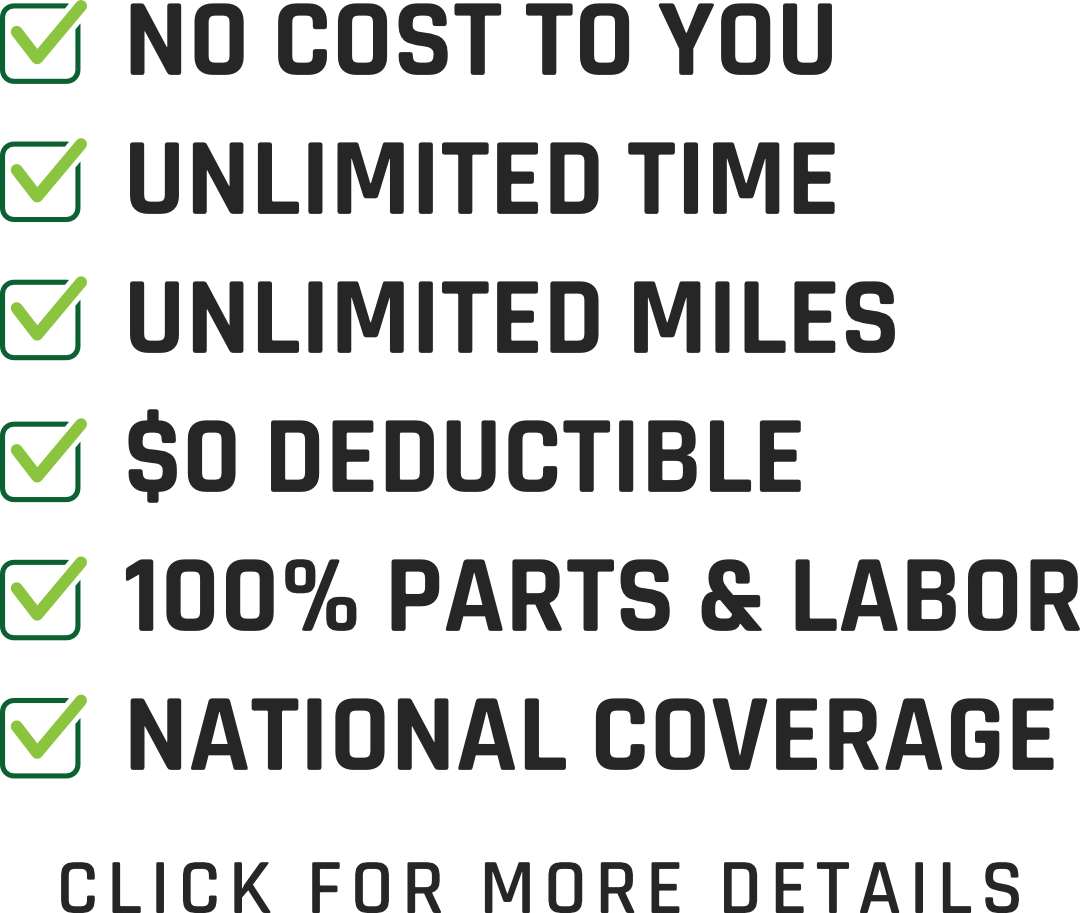

At Boyd Chevrolet, we understand that everyone's financial journey is different. Our experienced finance team works to find flexible auto financing solutions tailored to your specific credit situation. Whether you're rebuilding your credit after financial difficulties or establishing credit for the first time, we're here to make the financing process straightforward.

If you’re applying for an auto loan when dealing with bad credit challenges, read on to learn our finance team’s top tips!

Check Your Credit Score

The FICO automotive scoring system uses a scale from 250 to 900, with scores below 600 falling into the subprime category. Your score reflects several key factors, including your current debts, the types of credit accounts you maintain, the length of your credit history, and, most importantly, your track record of making payments on time.

Knowing your credit score and understanding your credit situation before visiting auto dealerships in North Carolina will give you a better idea of where you stand and what you might qualify for. Start by requesting your credit report from all three major credit bureaus: Experian, Equifax, and TransUnion. Review your credit score and scan for any errors or inaccuracies that might be dragging down your rating.

Fortunately, many lenders look beyond the numbers and consider your overall financial picture, including your current income level and job stability. When applying for financing with a low credit score, come prepared with documentation that shows steady employment and a reliable income. This additional proof can make a big difference in your approval odds and loan terms.

Pre-qualify with Multiple Lenders

Pre-qualification sends a soft inquiry, allowing you to check your eligibility and loan terms before applying, and should not negatively impact your credit score. When you get pre-qualified, you’ll know how much you can afford to spend on your new vehicle.

Consider a Co‑Signer

If you have a family member or trusted person with strong credit, they can co-sign your auto loan and help you qualify for lower interest rates. However, remember that if the loan becomes delinquent, it will impact both your credit score and your co-signer's credit score. Be sure to weigh the risks and benefits carefully before choosing a co-signed loan.

Save for a Down Payment

If you’re struggling with credit and on a tight budget, you’re probably wondering if it’s possible to get a car loan with bad credit and no down payment. Unfortunately, when dealing with bad credit auto financing, you usually have to make a down payment. You could be approved for less than you think, though. Most subprime lenders require a down payment of 10% or $1,000, whichever is greater.

The Advantages of Making A Large Down Payment

Contrary to popular belief, you don’t need to have a large down payment to secure a bad credit car loan. But a down payment reduces the loan amount upfront and shows the lender you're serious about this financial commitment, even if your credit score isn't perfect.

While you can make the minimum down payment, you should also know that making a larger down payment can be helpful. Here are just a few of the benefits of making a bigger down payment:

- Improves your chances of securing the loan – A bigger down payment shows you’ve been able to secure more savings and you’re committed to completing the loan.

- Lowers your monthly payment – The bigger the down payment, the less you’re financing, and the lower your monthly payment!

- Can shorten the loan term – Because a bigger down payment reduces the overall amount you’re financing, it helps you shorten the length of your loan.

- Reduces interest charges – The more you pay upfront, the less you’ll pay in interest over the term of the loan, which is especially helpful if you have a high interest rate.

Here are some ways you can come up with a down payment:

- Cash – Save money and use it to make the down payment.

- Trade-in – If you're planning to trade in your current vehicle, you can apply the trade-in value as a down payment.

- Combination of both – Maximize your down payment with a combination of both cash and trade-in equity.

Start Your Car Buying Journey with Our Chevy Finance Team in Hendersonville!

The road to auto loan approval starts at Boyd Chevrolet!

If you’re ready to discuss applying for a bad credit car loan near Asheville, talk with one of our Chevy finance team members. We offer personalized financing for customers of all credit backgrounds. Our finance team will review your situation to help you get into a reliable new vehicle.

Get pre-approved online today or visit us at Boyd Chevrolet!